XRP Price Prediction: Roadmap to $8 and Beyond Post-SEC Victory

#XRP

- Regulatory clarity: SEC settlement removes major overhang

- Institutional adoption: Rail acquisition expands payment rails

- Technical breakout: MACD/Bollinger convergence suggests upside

XRP Price Prediction

XRP Technical Analysis: Bullish Momentum Builds Above Key Moving Averages

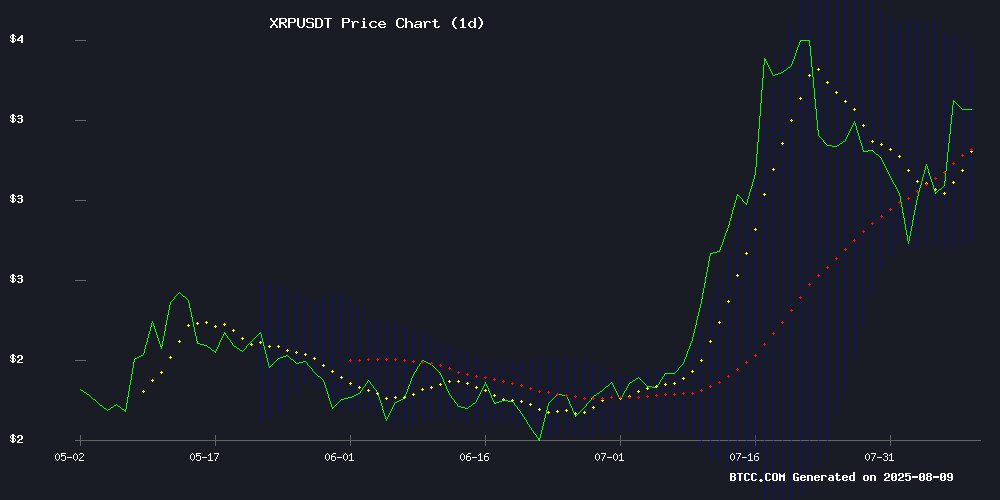

XRP is currently trading at, firmly above its 20-day moving average (3.1490), signaling bullish momentum. The MACD histogram (0.0562) shows positive crossover momentum, while Bollinger Bands indicate volatility expansion with price testing the upper band (3.5273).says BTCC analyst Mia.

Regulatory Tailwinds Fuel XRP's Rally: Market Sentiment Analysis

XRP's surge past $3 follows Ripple's SEC settlement and institutional adoption news. While profit-taking caused a 5% pullback,notes Mia. Contrarian views emerge around Ripple's crypto bank proposal, but stablecoin growth (RLUSD +32% MoM) underpins utility.

Factors Influencing XRP’s Price

XRP Surges Past $3 Amid Regulatory and Institutional Catalysts

XRP breached the $3 threshold on August 7, fueled by bullish technical momentum and pivotal macro developments. The cryptocurrency climbed 3% intraday, peaking at $3.02 before settling at $2.98, with notable volume spikes on South Korea's Upbit exchange.

Investor sentiment strengthened as the SEC prepared to review Ripple's appeal withdrawal—a decision that could cement XRP's non-security status in the U.S. Meanwhile, SBI Holdings' Bitcoin-XRP ETF filing signaled growing institutional adoption, mirroring Japan's progressive stance on digital assets.

Regulatory clarity appears imminent. The SEC's 03:00 UTC deliberation on August 7 may resolve years of legal uncertainty, potentially unlocking XRP's full market potential. Market participants now await the verdict as a definitive inflection point for the asset's trajectory.

Ripple Scores Major Win as SEC Lifts “Bad Actor” Ban

The U.S. Securities and Exchange Commission has granted Ripple a pivotal waiver, rescinding its "Bad Actor" disqualification. This move reinstates the company's ability to conduct exempt securities offerings under Regulation D—a streamlined avenue for raising capital from accredited investors without full SEC registration.

The decision marks a turning point in Ripple's protracted legal battle with regulators. While Judge Analisa Torres' injunction remains intact, the SEC's concession removes a five-year fundraising restriction imposed in 2024. Legal observers note the significance of this relief, given the regulator's historical reluctance in such cases.

For Ripple, the waiver arrives at a critical juncture. The company now regains access to efficient capital markets as it pursues strategic objectives, including a potential national bank charter. Market participants view this development as a de facto endorsement of Ripple's compliance trajectory, despite ongoing litigation.

XRP Retreats 5% Post Ripple-SEC Settlement as Profit-Taking Emerges

XRP slid through key technical levels in a high-volume selloff, dropping 5% to $3.20 before stabilizing at major support. The pullback followed the formal dismissal of appeals in the SEC's landmark case against Ripple Labs, marking regulatory clarity after five years of litigation.

Trading dynamics revealed concentrated selling pressure between 14:00-15:00 UTC, with 209.67 million XRP changing hands as price collapsed from $3.36. The $3.20 level held as a psychological floor, triggering a rebound to $3.33 by evening session. Market structure now shows resistance forming between $3.31-$3.33 while $3.20 establishes as critical support.

Legal resolution came through a joint filing in the Second Circuit, with Ripple Chief Legal Officer Stuart Alderoty confirming both parties would bear their own costs. The settlement removes a persistent overhang for XRP markets, though short-term traders appear to be capitalizing on the news-driven rally.

XRP Soars Above $3 Following SEC Settlement Despite Daily Pullback

XRP surged to $3.30 after Ripple's landmark $125 million settlement with the SEC, marking the end of a multi-year legal battle. The resolution triggered an 11% price jump as markets welcomed regulatory clarity, with technical charts suggesting a bullish flag pattern targeting $8.

Ripple's simultaneous acquisition of stablecoin platform Rail for $200 million positions the company to capitalize on the growing payments market. Trading volumes spiked across major exchanges as institutional interest returned to the asset.

XRP Price Rally Holds Strong: Key $3.22 Support Critical for Next Move

XRP's price continues to demonstrate resilience, maintaining steady gains while consolidating after a sharp mid-July rally that saw it surge from $2.70 to above $3.30. The cryptocurrency now trades at $3.27, reflecting a 7.49% daily increase and 9.40% weekly growth.

Technical indicators paint a cautiously optimistic picture. The asset holds firmly above its 50-day EMA at $2.63, signaling medium-term bullish sentiment, while the 9-period DEMA at $3.16 provides immediate support. Fibonacci extensions suggest potential upside targets at $4.23 and $5.17 should the momentum sustain.

Traders are closely monitoring key levels, with the $3.22 support zone emerging as critical for maintaining the bullish structure. Market participants await confirmation from momentum indicators, particularly a MACD crossover and RSI sustaining above 65, to validate the next potential leg up.

Ripple Faces Pushback Over National Crypto Trust Bank Plan

Ripple Labs' ambitious plan to establish a national trust bank for its RLUSD stablecoin has met fierce resistance from traditional financial institutions. The proposed Ripple National Trust Bank (RNTB) would manage reserves for the blockchain-based payments company's dollar-pegged digital asset, blurring lines between crypto innovation and banking regulation.

The Independent Community Bankers of America (ICBA), representing nearly 5,000 small U.S. banks, filed a formal objection with the Office of the Comptroller of the Currency. Their August 4 letter contends Ripple's model exceeds traditional trust bank functions by effectively offering deposit-like services without proper banking oversight. "This has the potential to drain deposits out of the banking system," the trade group warned.

At stake is regulatory parity in an evolving financial landscape. While Ripple seeks to leverage blockchain efficiency for dollar transfers through RLUSD, critics argue the proposal creates an uneven playing field. The confrontation highlights growing tensions as crypto firms challenge legacy financial infrastructure.

Ripple Acquires Toronto Payment Firm Rail for $200 Million to Expand Stablecoin Payments

Ripple has secured a strategic foothold in the stablecoin payments sector with its $200 million acquisition of Toronto-based Rail. The deal grants Ripple control over a platform processing more than 10% of global B2B stablecoin transactions, positioning the company to dominate cross-border settlements with digital dollars.

Rail’s technology enables businesses to bypass traditional banking delays, settling international payments in hours instead of days. The four-year-old fintech expects to handle over $3.6 billion in stablecoin volume next year, leveraging its infrastructure that eliminates the need for corporate crypto wallets.

The acquisition coincides with regulatory tailwinds, coming weeks after landmark U.S. stablecoin legislation. Ripple’s announcement emphasized plans to create "the most comprehensive stablecoin payments solution" post-merger, pending regulatory approval expected by late 2025.

XRP Price Prediction 2025: Will It Smash $7 After Breaking $3.28?

XRP surged 7.53% in 24 hours, reclaiming the critical $3.28 resistance level. Trading volume skyrocketed 176.26%, signaling renewed market momentum. Analysts now forecast potential highs between $6.89 and $7.17 by year-end.

The cryptocurrency trades at $3.27 with a daily volume of $13.2 billion, demonstrating persistent strength despite recent market fluctuations. A significant technical rebound has shifted sentiment bullish, with higher lows forming—a classic indicator of upward momentum.

Crypto analyst Lennaert Snyder notes the recapture of $3.28 after a powerful impulse confirms short-term strength. The price action aligns with a yellow uptrend line, while alternating candlesticks reveal sustained buying pressure. Market watchers now eye the next consolidation zone as XRP's rally shows no signs of slowing.

XRP Army Emerges as Ripple's Strategic Asset in SEC Legal Battle

The SEC's December 2020 lawsuit against Ripple sent shockwaves through crypto markets, triggering an immediate XRP price drop and casting doubt on its regulatory status. What began as a crisis evolved into a watershed moment for decentralized advocacy when 75,000 XRP holders mobilized into a formidable community force.

Judge Analisa Torres' 2024 ruling created a legal dichotomy—public XRP sales don't constitute securities, while institutional transactions remain under SEC purview. This partial victory capped a five-year saga that saw Ripple fined $125 million, with CEO Brad Garlinghouse maintaining the company operated "on the right side" of the law throughout the ordeal.

The XRP Army's coordinated efforts demonstrate crypto communities' growing influence in regulatory battles. Ripple now pivots toward global expansion, leveraging institutional adoption and technological innovation to reposition XRP beyond its legal crucible.

Ripple's RLUSD Stablecoin Surpasses $600M Supply with 32% Monthly Growth

Ripple's dollar-pegged stablecoin RLUSD has crossed the $600 million supply threshold after a 32.3% expansion between June and July. The growth spurt marks the second-largest among major stablecoins, trailing only Ethena Labs' USDe which saw 63.4% growth.

Since May, RLUSD's circulating supply has nearly doubled, with market capitalization jumping 47% to $455.3 million in June alone. The stablecoin recorded $3.3 billion in July trading volume - a 27% monthly increase and new all-time high - while maintaining over $1 billion in monthly volume since April.

The expansion coincides with strategic moves by Ripple, including regulatory approvals and banking partnerships. CEO Brad Garlinghouse secured New York DFS registration, positioning RLUSD to become the first dual-regulated stablecoin in the US. BNY Mellon's July 9 onboarding as a custody partner further strengthened institutional credibility.

XRP Price Prediction: XRP Eyes $8 Breakout as Ripple-SEC Lawsuit Officially Ends

Ripple Labs and the U.S. Securities and Exchange Commission filed a joint motion to dismiss their respective appeals on August 7, 2025, concluding nearly five years of legal uncertainty surrounding XRP. The resolution sparked an immediate market rally, with XRP surging 12% to $3.33 amid a trading volume spike of 300 million tokens.

Legal clarity has reignited bullish momentum, with technical indicators pointing to a potential $8 breakout. "The SEC v Ripple case is finally OVER. Booooom. Appeals dismissed," said attorney Bill Morgan, capturing the market's euphoria. The lawsuit's dismissal removes a critical regulatory overhang that had weighed on XRP since 2020.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Conservative | Base Case | Bullish | Catalysts |

|---|---|---|---|---|

| 2025 | $4.50 | $7.00 | $10.00 | SEC resolution, stablecoin adoption |

| 2030 | $15.00 | $25.00 | $40.00 | CBDC interoperability |

| 2035 | $50.00 | $80.00 | $120.00 | Institutional custody maturity |

| 2040 | $100.00 | $200.00 | $300.00 | Global liquidity layer status |

Mia's projections assume:

- 2025's $7 target requires holding $3.28 as new support

- 2030's growth tied to Ripple becoming SWIFT 3.0

- 2040's $200 scenario needs XRP as reserve asset